Overview

Spree has a highly flexible payments model which allows multiple payment methods to be available during checkout. The logic for processing payments is decoupled from orders, making it easy to define custom payment methods with their own processing logic.

Payment methods typically represent a payment gateway. Gateways will process card payments, and may also include non-gateway methods of payment such as Check, which is provided in Spree by default.

The Payment model in Spree tracks payments against Orders. Payments relate to a source which indicates how the payment was made, and a PaymentMethod, indicating the processor used for this payment.

When a payment is created, it is given a unique, 8-character identifier. This is used when sending the payment details to the payment processor. Without this identifier, some payment gateways mistakenly reported duplicate payments.

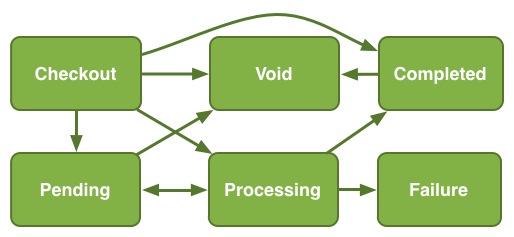

A payment can go through many different states, as illustrated below.

An explanation of the different states:

checkout: Checkout has not been completedprocessing: The payment is being processed (temporary – intended to prevent double submission)pending: The payment has been processed but is not yet complete (ex. authorized but not captured)failed: The payment was rejected (ex. credit card was declined)void: The payment should not be counted against the ordercompleted: The payment is completed. Only payments in this state count against the order total

The state transition for these is handled by the processing code within Spree; however, you are able to call the event methods yourself to reach these states. The event methods are:

started_processingfailurependcompletevoid

Payment Methods

Payment methods represent the different options a customer has for making a payment. Most sites will accept credit card payments through a payment gateway, but there are other options. Spree also comes with built-in support for a Check payment, which can be used to represent any offline payment. There are also third-party extensions that provide support for some other interesting options such as better_spree_paypal_express.

A PaymentMethod can have the following attributes:

type: The subclass ofSpree::PaymentMethodthis payment method represents. Uses rails single table inheritance feature.name: The visible name for this payment methoddescription: The description for this payment methodactive: Whether or not this payment method is active. Set itfalseto hide it in frontend.environment: The Rails environment (Rails.env) where this payment method is activedisplay_on: Determines where the payment method can be visible. Values can befrontfor frontend,backfor backend orbothfor both.

Payment Method Visibility

The appearance of the payment methods on the frontend and backend depend on several criteria used by the PaymentMethod.available method. The code is this:

def self.available(display_on = 'both') all.select do |p| p.active && (p.display_on == display_on.to_s || p.display_on.blank?) && (p.environment == Rails.env || p.environment.blank?) end end

If a payment method meets these criteria, then it will be available.

Auto-Capturing

By default, a payment method’s auto_capture? method depends on the Spree::Config[:auto_capture] preference. If you have set this preference to true, but don’t want a payment method to be auto-capturable like other payment methods in your system, you can override the auto_capture? method in your

PaymentMethod subclass:

class FancyPaymentMethod < Spree::PaymentMethod def auto_capture? false end end

The result of this method determines if a payment will be automatically captured (true) or only authorized (false) during the processing of the payment.

Payment Processing

Payment processing in Spree supports many different gateways, but also attempts to comply with the API provided by the active_merchant gem where possible.

Gateway Options

For every gateway action, a list of gateway options are passed through.

emailandcustomer: The email address related to the orderip: The last IP address for the orderorder_id: The Order’snumberattribute, plus theidentifierfor each payment, generated when the payment is first createdshipping: The total shipping cost for the order, in centstax: The total tax cost for the order, in centssubtotal: The item total for the order, in centscurrency: The 3-character currency code for the orderdiscount: The promotional discount applied to the orderbilling_address: A hash containing billing address informationshipping_address: A hash containing shipping address information

The billing address and shipping address data is as follows:

name: The combinedfirst_nameandlast_namefrom the addressaddress1: The first line of the address informationaddress2: The second line of address informationcity: The city of the addressstate: An abbreviated version of the state name or, failing that, the state name itself, from the relatedStateobject. If that fails, thestate_nameattribute from the address.country: The ISO name for the country. For example, United States of America is “US”, Australia is “AU”.phone: The phone number associated with the address

Credit Card Data

Spree stores only the type, expiration date, name and last four digits for the card on your server. This data can then be used to present to the user so that they can verify that the correct card is being used. All credit card data sent through forms is sent through immediately to the gateways, and is not stored for any period of time.

Processing Walkthrough

When an order is completed in spree, each Payment object associated with the order has the process! method called on it (unless payment_required? for the order returns false), in order to attempt to automatically fulfill the payment required for the order. If the payment method requires a source, and the payment has a source associated with it, then Spree will attempt to process the payment. Otherwise, the payment will need to be processed manually.

If the PaymentMethod object is configured to auto-capture payments, then the Payment#purchase! method will be called, which will call PaymentMethod#purchase like this:

payment_method.purchase(<amount>, <source>, <gateway options>)

If the payment is not configured to auto-capture payments, the Payment#authorize! method will be called, with the same arguments as the purchase method above:

payment_method.authorize(<amount>, <source>, <gateway options>)

How the payment is actually put through depends on the PaymentMethod sub-class’ implementation of the purchase and authorize methods.

The returned object from both the purchase and authorize methods on the payment method objects must be an ActiveMerchant::Billing::Response object. This response object is then stored (in YAML) in the spree_log_entries table. Log entries can be retrieved with a call to the log_entries association on any Payment object.

If the purchase! route is taken and is successful, the payment is marked as completed. If it fails, it is marked as failed. If the authorize method is successful, the payment is transitioned to the pending state so that it can be manually captured later by calling the capture! method. If it is unsuccessful, it is also transitioned to the failed state.

Once a payment has been saved, it also updates the order. This may trigger the payment_state to change, which would reflect the current payment state of the order. The possible states are:

balance_due: Indicates that payment is required for this orderfailed: Indicates that the last payment for the order failedcredit_owed: This order has been paid for in excess of its totalpaid: This order has been paid for in full.

You may want to keep tabs on the number of orders with a payment_state of failed. A sudden increase in the number of such orders could indicate a problem with your credit card gateway and most likely indicates a serious problem affecting customer satisfaction. You should check the latest log_entries for the most recent payments in the store if this is happening.

Log Entries

Responses from payment gateways within Spree are typically ActiveMerchant::Billing::Response objects. When Spree handles a response from a payment gateway, it will serialize the object as YAML and store it in the database as a log entry for a payment. These responses can be useful for debugging why a payment has failed.

You can get a list of these log entries by calling the log_entries on any Spree::Payment object. To get the Active::Merchant::Billing::Response out of these Spree::LogEntry objects, call the details method.

Supported Gateways

Access to a number of payment gateways is handled with the usage of the spree_gateway extension. This extension currently supports the following gateways:

- Authorize.Net

- Balanced

- Beanstram

- Braintree

- eWAY

- LinkPoint

- Moneris

- PayPal

- Sage Pay

- Samurai

- Skrill

- Stripe

- USA ePay

- WorldPay

With the spree_gateway gem included in your application’s Gemfile, these gateways will be selectable in the admin backend for payment methods.

These are just some of the gateways which are supported by the Active Merchant gem. You can see a list of all the Active Merchant gateways on that project’s GitHub page.

In order to implement a new gateway in the spree_gateway project, please refer to the other gateways within app/models/spree/gateway inside that project.

Adding your custom gateway

In order to make your custom gateway show up on backend list of available payment methods you need to add it to spree config list of payment methods first. That can be achieved by adding the following code in your spree.rb for example:

Rails.application.config.spree.payment_methods << YourCustomGateway

better_spree_paypal_express and spree-adyen are good examples of standalone custom gateways. No dependency on spree_gateway or activemerchant required.